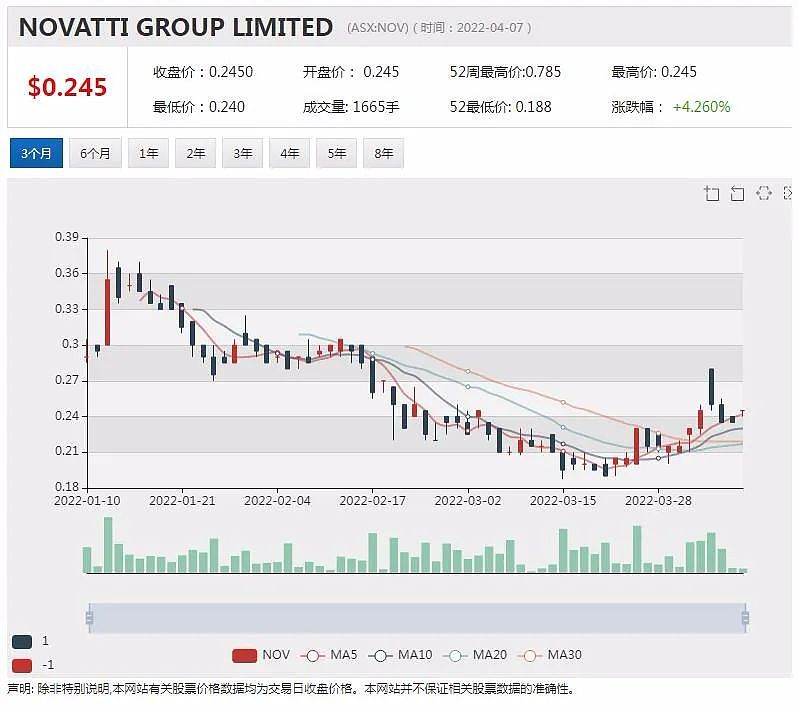

年均增长50% 四年3起并购 Fintech明星股Novatti全球业务生态初成 如何延续高成长逻辑?

——专访澳交所上市公司Novatti集团(ASX:NOV)CEO彼得·库克(Peter Cook)先生

导读:

企业只有走向数字化才能生存、创造利润并增长,其付款方式也必然要经历数字化。数字化变革正在颠覆包括“支付”在内的金融服务方式。现金付款几乎成为历史,但显然许多企业还没有足够的能力或知识获取现代化的支付服务。

澳交所上市金融科技公司Novatti(ASX:NOV)提供的解决方案能够使企业无论在何地都可从任意设备端进行收付款交易。过去四年,Novatti营收以每年50%的速度保持增长,且增长势头依然强劲。它对于并购有着强烈“胃口”,四年之间完成了3起收购交易。

基于澳洲、新西兰、加拿大和欧洲的金融服务牌照,这家公司的全球“朋友圈”不断扩大,已成为支付宝、微信支付、银联支付、Visa和万事达卡的首要合作伙伴,Chinapayments业务更是开创了中国居民跨境账单支付的先河。

作为澳洲金融科技行业领先公司,Novatti增长驱动力源自哪里?它是如何进行差异化发展,核心竞争优势是否可持续?不断扩大的全球“朋友圈”和激进并购的背后,公司有着怎样的扩张逻辑?作为率先关注中国移民人士跨境支付需求的公司,对于这一细分市场有怎样的展望和研判?对于关注其增长前景的市场投资者而言,Novatti下阶段的业绩支撑点和爆发点又有哪些?

带着上述问题,ACB News高管访谈栏目于近期视频采访了Novatti集团CEO彼得·库克(Peter Cook)先生,以下为本次访谈内容实录:

Peter Cook在线接受本网采访(图片来源:ACB News)

Q1: ACB News 澳华财经在线:今天我们很高兴请到彼得·库克,Novatti集团(ASX澳交所代码NOV)首席执行官接受采访。彼得,欢迎做客ACB News澳华财经在线。我们知道您曾任职多家企业,有超过25年担任公司高管的经验,请向澳华财经在线的读者介绍下您的背景。

彼得·库克:澳华财经在线的读者朋友们,你们好。我在澳洲本土以及海外的业务发展方面拥有丰富经验,特别是在新技术应用和建立客户基础方面。具体而言,我的职业生涯其实始于电子通讯行业。然后,在过去10到12年里转向了金融服务业,我们通过向市场推出新技术,帮助消费者改善他们的生活。早年我是预付费移动电话行业的开拓者,近些年则开始立足金融服务领域,专注新型数字钱包发行和收单等业务,这些业务都是通过澳交所上市公司Novatti集团进行的。

Q2: ACB News 澳华财经在线:您能告诉我们有关Novatti集团的更多信息吗?Novatti的收入来源是什么?

彼得·库克:Novatti集团是一家企业对企业(B2B)支付服务提供商。我们通过建设一个包含大量基础设施的生态系统,能够向其他银行以及金融服务公司、外国企业和海外商户提供支付服务。当我们谈到支付行业生态系统时,指的是相关牌照技术和商业合作伙伴关系。比如说,Novatti拥有澳洲和其他国家监管机构批准下发的牌照,有Visa和万事达卡的许可证,也有中国银联、支付宝、微信支付等公司的许可证,所以能够合规经营相关业务。我们拥有很多金融科技方面的技术,并在澳大利亚、欧洲和亚洲都有商业运营团队。

Q3: ACB News 澳华财经在线:可否谈一下Novatti集团的竞争优势和目前公司的运营情况。Novatti和同行业公司相比有什么不同之处?

彼得·库克:对我们而言,最重要的是获得金融服务相关的监管许可证和牌照。许可证是公司基础设施的核心部分,所以有业务运营围绕许可证的审批许可展开。我之前提到,Novatti在澳洲和一些海外国家都有牌照,我们也一直在申请更多许可证。因此,对于这个行业而言,真正的竞争优势在于是否有牌照。牌照通常需要很长时间才能拿到,并且并不是每家公司都能申请到。继而在牌照的基础上,我们形成各种合作伙伴关系,包括与支付宝、微信支付、中国银联、Ripple、Stella、Visa、万事达卡以及很多全球性公司的合作。可以说,通过拥有牌照、合作伙伴关系和技术,我们正在打造一种可持续的竞争优势。

Q4: ACB News 澳华财经在线:您之前提到,Novatti与支付宝、微信是合作伙伴关系,并且Novatti在2018年建立了中国业务支付系统Chinapayments,让中国居民能够支付澳大利亚的账单,这块业务现在运营的怎么样?

彼得·库克:这是一项伟大的创新。实际上这个商业想法来自于我们的一名中国工作人员。通过Chinapayments,中国的消费者,无论身在中国还是澳大利亚,只要能够使用微信支付、支付宝或银联,就可以直接支付在澳洲的账单,包括澳洲的电话费、水电费以及其他消费服务,费用将直接从他们在中国的钱包中扣除。从我们掌握的信息来看,这项创新几乎是世界首次。对中国消费者而,在澳洲用他们的中国钱包来付账,能让支付变得简单和容易,并且非常划算。

Q5: ACB News 澳华财经在线:中国家长可以通过Chinapayments支付学费吗?

彼得·库克:可以。事实上,很多中国学生或者他们的父母需要支付澳洲大学和学校的学费,也要支付公寓租金以及其他服务费用,包括电话费、电费或水费等。这些都可以用ChinaPayments支付,非常的方便。

Peter Cook在线接受本网采访(图片来源:ACB News)

Q6: ACB News 澳华财经在线:您对5年后的ChinaPayments有什么样的期待?

彼得·库克:目前我们一直在扩大业务规模,与去年同期相比这块业务增长率约为100%。我们已得到支付宝、微信支付和银联支付的强有力支持,他们认为ChinaPayments可以给客户带来增值服务。如果我们能够保持每年50%-100%的增长率,五年后总交易额可能会增长到10亿澳元规模,并且ChinaPayments能够真正帮助到往返于中澳,在澳洲拥有房产,在澳留学或有任何澳洲账单支付需求的中国居民。

Q7: ACB News 澳华财经在线:2022财年上半年,Novatti实现高速增长,销售收入提升51%,达到1110万澳元。哪个业务部门对收入的贡献最大?

彼得·库克:我们连续四年都在以每年约50%的速度增长。在战略层面,我们的目标是至少保持这一增速。值得注意的是,Novatti核心的金融交易处理业务一直在以每年大约100%的速度增长。另外有一些历史悠久的技术部门,它们的增长相对较慢,我们的总体增速受到影响而有所减缓。但实际上,如果保持每年50%的增长,Novatti也会成为一家非常大的公司。当然,未来一年,我们首先要通过盈利关卡。

Q8: ACB News 澳华财经在线:你认为上半年Novatti做过的最重要的事情是什么?

彼得·库克:最重要的事情是启动了收单业务,现在我们可以让商家接收使用VISA卡、万事达卡和银联卡的消费付款。再过两年,这很可能成为Novatti最大的一块业务。推出收单业务的同时,我们的发行业务规模也翻了一番。随着更多服务推向市场,我们的增长率不断攀升。另一件事是,上半年我们在马来西亚收购了一家名为ATX的公司,这是Novatti第一次进行海外收购,这起交易将驱动我们进一步增长。谈到海外业务,Novatti现在有一支团队正在欧洲开展运营,我们还在美国部署了一个业务小组,销售名为Emersion的帐单服务。

Q9: ACB News 澳华财经在线:Novatti的团队分布在澳大利亚、亚洲、欧洲和美国等不同的国家和地区,可否进一步谈谈Novatti的商务合作伙伴关系和拓展计划?

彼得·库克:并购与战略投资在金融科技行业十分普遍,Novatti也有很多收购活动。去年6月,我们宣布战略性收购澳交所上市公司Reckon (ASX:RKN)部分股权,Novatti现在拥有该公司19.9%的股权。

Q10: ACB News 澳华财经在线:这些收购背后的原因是什么?Novatti将如何从Reckon的会计软件业务中获益?

彼得·库克:Reckon主供提供会计软件,作为SaaS (软件即服务)企业,他们有大约10万名顾客。Novatti现在拥有Reckon 19.9%的股权,是他们的最大股东。通过投资这家公司,Novatti可以向他们多达10万名的客户提供支付服务。事实上,在业务推广上我们进展很顺利。接下来三四年里,我们希望能够向Reckon的许多客户提供Novatti的支付服务。如此来看,等于我们拥有一个10万多人的巨大潜在市场。同时,Reckon的盈利水平非常好,仅仅作为该公司的投资者,我们目前每年可收到100多万澳元的股息。这是一项非常好的投资。

Q11: ACB News 澳华财经在线:在你看来,全球B2B支付生态系统的未来是怎样的?您如何看待未来机遇?

彼得·库克:未来在B2B支付领域,我们将看到很多基于区块链网络的创新,并且不同国家之间,不同国家的企业之间会出现更大程度的一体化。比如,澳洲和中国有大量贸易往来,并且贸易量预计将持续增长,人们希望能够更为便利地进行付款,企业与企业之间也希望能够高效快速地进行支付,Novatti致力于为此提供解决方案,并进行了提前布局。我们深度已参与多个区块链战略,拟将部署区块链中的稳定币,为未来的实际应用做准备,比如可能会用于中国央行数字货币相关的合作上。除此外,我们也在拓展其他现代支付服务,包括与中国支付公司建立密切合作关系。目前我们和银联、支付宝和微信支付均已建立良好合作关系。

Q12: ACB News 澳华财经在线:您能详细介绍下Novatti正在建立的支付生态系统吗?从不同方面,比如技术、许可证、合作关系以及Novatti的团队。

彼得·库克:在我们看来,如果你是一家制造企业,基础设施指的是制造各种设备的生产线,作为一家支付公司,基础设施则是与其他支付公司、与银行合作的能力,以及可能会使用其服务的潜在客户。之前谈到,我们建设基础设施的第一步是获得相关许可证,然后需要开发大量新技术。Novatti有许多非常现代化的创新技术平台,另外,由于Novatti是持有支付服务许可证的上市公司,凭借这重优势,我们已经与许多公司达成合作,比如与微信支付、支付宝、银联的合作。Novatti是澳洲拥有全球合作伙伴关系的大型公司之一。以此为基础,面对有金融交易服务需求的公司,Novatti能够提供合规的许可证和技术,并通过我们的支付系统为这些公司提供服务。

Peter Cook在线接受本网采访(图片来源:ACB News)

Q13: ACB News 澳华财经在线:我们来谈谈Novatti的未来前景。当我们投资一家公司的时候,我们投资的是这家公司的未来。2019年,Novatti的目标是成为澳洲领先的服务移民人士的银行。三年过去了,这还是Novatti想要实现的目标吗?

彼得·库克:这需要分几点来回答。首先看下Novatti及我们支付业务的发展情况。Novatti的收入正以每年50%的速度增长,按照计划将在一到一年半的时间内实现正向营业现金流。未来我们的目标是发展成为一家足迹遍布全球的大型支付公司。除支付业务外,我们已经在澳洲申请了银行牌照,并且预计很快会拿到。有了银行牌照后,我们将主要服务本地移民和企业,以及即将来澳或在澳洲有潜在商业、家庭关系的人士。他们或许身在其他国家,但凭借在澳大利亚的银行牌照,我们将可以为他们提供各类银行服务。Novatti将会成为一家创新性数字银行,专门服务重点客户,比如,在澳洲有家人或贸易往来的中国人,或者想到澳洲来的中国人。Novatti的银行业务现已进行到审批的最后阶段。

Q14: ACB News 澳华财经在线:如果Novatti能在今年拿到银行牌照,对Novatti来讲意味着什么?

彼得·库克:我们今年拿到银行牌照的可能性很高。如果顺利达成,作为一家上市公司,Novatti可以说完成了一件极其困难的事。从股市角度讲,新投资者会注意到Novatti,并对公司前景持非常积极的看法。获得银行牌照后我们将可以拓展新的银行服务,并吸引更多新客户。银行服务本身也会在两三年内成为一项极具盈利能力的业务。

Q15: ACB News 澳华财经在线:我们再来谈谈Novatti的合作伙伴关系。Novatti即将获得银行牌照,并且已经与全球多家支付公司建立了合作伙伴关系。这些合作伙伴关系对Novatti意味着什么?Novatti如何从这些合作伙伴关系中获得收入?又如何做到将旗下支付生态系统效益最优化?

彼得·库克:建立全球合作伙伴关系,意味着Novatti已经成为整个支付生态系统中的重要一员。举个例子:Novatti在新西兰拥有发行卡片的监管许可证,并在当地与Visa有合作关系。BNPL公司Afterpay希望在新西兰发行虚拟Visa卡,所以与Novatti签署了合同,由我们为他们发行卡片。从本质上讲,正是这些合作伙伴关系,比如新西兰的发行许可证加上与Visa的全球合作伙伴关系,给我们带来了AfterPay这样的大客户。与此同时,在澳洲,我们与区块链公司Ripple建立有合作关系,通过这层伙伴关系,我们又与许多亚洲国家的公司成为合作伙伴。他们乐意与Ripple和Novatti建立合作。可以说,全球合作伙伴关系最终能为我们带来更多业务。

Q16: ACB News 澳华财经在线:从个人角度看,您希望5年之后Novatti会成为怎样的公司?

彼得·库克:五年后,我希望Novatti成为一家市值数十亿澳元的公司,经营足迹遍布全球,成为世界上最大的支付公司之一。

ACB News 澳华财经在线:我们期待这一天的到来。本次采访到此结束。非常感谢您抽出时间接受采访。

彼得·库克:谢谢。

附:访谈英文版

——Interview with Novatti CEO Peter Cook——

Q1: ACB News:Today we are very pleased to have Peter Cook,the CEO of Novatti Group (ASX Code: NOV) to join us. Welcome Peter. We know that you have over 25 years experience as a director and executive with multiple companies. Could you please introduce more about yourself to our readers?

Peter Cook: Hello, ACB News readers. My background is in building businesses both in australia and overseas where it's really been at the interface of new technologies and building customer bases. So my background was really in telecommunications businesses and then for the last 10 to 12 years in financial services businesses where we bring new technologies to market and enable consumers to improve their lives by the advent of new new technology. So you know, in an earlier time I was a pioneer in prepaid mobile telephone and then more recently in financial services with new sorts of digital wallets issuing and acquiring businesses and things like that. All of which is being done under Novatti group limited which is a ASX listed company.

Q2: ACB News:Can you please tell us more about Novatti's business ? What are Novatti's revenue streams?

Peter Cook: So Novatti is a business-to-business payment service provider. And by that I mean that we have built an ecosystem, a lot of infrastructure, that enables us to provide payment services for other banks and financial services companies or foreign businesses and merchants. So when we talk about an ecosystem in payments, we talked about licenses technology and commercial partnerships. So, for instance Novatti has licenses in Australia and a number of other countries granted by regulators. We also have licenses from visa and MasterCard, from China Unionpay, Alipay, WeChat pay and other companies that enable us to operate certain businesses. We've got a lot of fintech technology and then, of course we've got commercial operations teams in Australia, Europe and Asia that enable us to run our business.

Q3: ACB News:Let us talk about Novatti's competitive advantages and current situation. How does Novatti differentiate itself from other industry players.

Peter Cook: We see that the single most important thing if you're offering financial services is to have relevant regulatory licenses. So everything we do is based around licenses. We see that as the core bit of infrastructure and as I said before we've got licenses in Australia and a number of overseas countries and in fact applying for more licenses all the time. So a true competitive advantage is having licenses which take a long time to get and not every company can get them. And then on those licenses, we have partnerships with AliPay, Wechat Pay, ChinaUnionpay, Ripple, Stella, Visa, Mastercard, many many global companies. So by having the licenses the partnerships and technology, we can build a sustainable competitive advantage.

Q4: ACB News:As you mentioned before Novatti has partnership with Wechat,Alipay and Novatti established ChinaPayments in 2018 which provides Chinese residents with a solution for Australian bills payments. How's the business going now?

Peter Cook: That has been a really great innovation. So it actually started off from one of our Chinese staff members who suggested this business idea. What we've enabled is Chinese consumers whether they're in China or in Australia who've got WeChatpay Alipay or Unionpay, they can pay Australian bills or you know, telephone bills, utility bills and other consumption services directly from their wallets in China. So this is allowed. It's nearly a first in the world as far as we understand. This innovation makes it simple and easy and very cost effective for Chinese consumers to use their Chinese wallets to pay bills in Australia.

Q5: ACB News:Can Chinese parents pay the tuition fee via ChinaPayments?

Peter Cook: They can. And in fact, we see that many Chinese students or their parents are paying university and school fees in Australia. They're also paying rent on apartments. They're paying other service fees. That might be telephone bills. It might be their electricity or water bills. All of those can be paid with ChinaPayments. That's very convenient.

Q6: ACB News:So what's your vision for ChinaPayments after 5 years?

Peter Cook: So at the moment we've been growing the business at about 100 percent year-on-year We have very, very strong support from Alipay, WeChat pay and Unionpay because they see that it's a great way to bring a service to the their customers. So if we create growing that at between 50 and 100 percent year-on-year, that could be doing a billion dollars of gross transaction value, really helping between China and Australia for Chinese residents who have got properties or students or bills to pay in Australia.

Q7: ACB News:In the first half financial year 2022, Novatti has achieved a high growth, fifty-one percent increase in sales revenue to 11.1 million. Which sector contributes the most revenue?

Peter Cook: So our total growth rate has been growing at about 50 percent per year for about four years in a row, and at a strategic level we aim to at least keep that growth rate going. Interestingly, in our core business of what we call financial transaction processing, we've actually been growing at about 100 percent per year. So the growth rate is slightly slowed down by having some historic technology businesses that have slow growth rates. But actually if we keep growing at 50 percent per year, we will become a very large company and of course, go through the profit barrier in the next year or so.

Q8: ACB News:What do you think was the most important thing Novatti has done in the first half year?

Peter Cook: So the most important thing is we've launched what's called an acquiring business, which is where we enable merchants to take payments from consumers with Visa card, MasterCard, and Unionpay and that will be, I would say, in two years time, that may well be the largest part of our business. So we've launched that and then what's called our issuing business has also doubled in size. So we're bringing more and more services to market, and you can see the growth rate really escalating. The other thing is in the first half of last financial year which finished in December, is we bought a company in Malaysia called ATX, and so that's our first overseas acquisition and then ATX will increase our growth rate as well And in fact, just talking about overseas, we've also now got a significant team operating in Europe and we've also deployed a team in the USA selling our billing service called Emersion.

Q9: ACB News:So Novatti now has teams in Australia Asia, Europe and the US. As you mentioned, Novatti now has branches in different countries and areas. So let us talk about the partnerships and expansion plan.

Peter Cook: Merge & acquisition and strategic investments are quite common within the fintech industry. Novatti has a lot of acquisition activities as well. Last June, Novatti announced acquisition of strategic stake in Reckon Limited (ASX:RKN). now Novatti has successfully acquired a 19.9% interest in Reckon.

Q10: ACB News:What are the reasons behind those acquisition?How does Novatti benefit from Reckon’s accounting software business?

Peter Cook: Yes, so just quickly. Reckon provides accounting software. As a SAAS (software as a service) business, they have about 100,000 customers and Novatti team now owns 19.9%. So we are their largest shareholder. The reason that we have invested in the company is that we can offer payment services to their one hundred thousand customers. And we are well progressed with launching services to those hundreds thousand customers. So over the next three or four years we would hope to be able to provide payment services to many of those customers. You can take a view that we now have a large addressable market of 100,000 plus customers that we can offer Novatti's payment services to. The other thing, which is very good is, the Reckon is a very profitable company and we receive at the moment over a million dollars a year in dividends just by being an investor in that company. It's a very good investment.

Q11: ACB News:From your perspective, what future we may see in global B2B payments ecosystem? How do you see the future opportunities?

Peter Cook: In future B2B payments, we see a lot will be based around blockchain networks and a drive for greater integration between countries and businesses between countries. So, for instance, between Australia and China, there is a lot of trade, and we see that the trade will continue to grow. people want to be able to pay. Each business wants to be able to pay the other business efficiently. Novatti is the method of dealing. Looking at this innovation in the future is that we're very involved in a number of blockchain strategies and in fact we will be deploying a stable coin which could work, for instance, with the China Central Bank digital currency. So we'll be deploying stable coin services. We’re also doing other modern payment services and trying to work very closely with Chinese payment companies. And, of course we're already doing with Unionpay, Alipay and WeChat Pay.

Q12: ACB News:Can you please introduce more information about the ecosystem that Novatti is building? Could you describe it in different aspects, like technology, license, partnership and Novatti's team?

Peter Cook: Okay, so just going back to how we think about infrastructure. If you're a manufacturing company you think about infrastructure as the assembly lines to all of the equipment you need to manufacture. As a payments company, infrastructure is about your ability to work with other payments companies and banks and the customers that are going to use your service. So as I've said earlier that the first part of how we think about infrastructure is being licensed, then we build a lot of technology. We've got a number of very modern innovative technology platforms. And then, of course we use our status as a public-listed company with licenses to get agreements with companies such as WeChat Pay, Alipay, Unionpay and others. So Novatti is now one of the major companies in Australia with global partnership. So with these global partnerships there are companies that want to do business. We have the right licenses and technology and then we can service those companies with our infrastructure.

Q13: ACB News:Thank you. Let us talk about the future vision because when we invest in a company we invest in the future of the company. Novatti aimed at creating Australia’s leading migrant bank in 2019. Three years later, is this still the goal for Novatti?

Peter Cook: So a few things there. Let's just look at Novatti and the payments business. We've been growing at about 50% per annual and we should become cash flow positive in about a year to 18 months time. That is the plan and become a very large payments company with a global footprint which we've already discussed. We've also applied for a bank license in Australia, and we think,we are very close to being issued that bank license. With the bank license, our business plan is about providing services for migrants and businesses and people that are coming to Australia or potentially have relationships in Australia. And maybe they're in another country, but we'll be using our Australian bank license to provide banking services for people that have relationships with Australia. So it'll be a digital bank. It'll be very innovative and it'll be focused on servicing, for instance, people from China who have got relatives or businesses in Australia, or want to come to Australia. Novatti’s banking business remains at the final stage to get approval.

Q14: ACB News:If Novatti gets banking license this year, what does it mean for Novatti?

Peter Cook: If we get the banking license this year, which I think is highly likely, then it will first of all, I think it'll mean in the share market sense, the company will be, new investors will look at the company and take a very positive view on the company, because we've done a very difficult thing as a public listed company. We're bringing in gaining one of these bank licenses. It will also allow us to deploy new services and bring on many new customers to use our banking services. And, of course the bank will become a very profitable business within two or three years itself as well.

Q15: ACB News:Let us go back to talk about partnerships more. As Novatti is getting banking license soon, Novatti formed partnerships with global payments leaders. What do those partnership mean for Novatti? How can Novatti leverage its ecosystem and generate revenue from its partnerships?

Peter Cook: So the global partnerships, in the end mean that you're nearly an important player in the payments ecosystem. Let me give you an example, Novatti has a regulatory license in New Zealand to be an issuer to issue cards. We have a partnership with Visa in New Zealand and then Afterpay, the buy now pay later company, wants to issue virtual Visa cards in New Zealand, so Afterpay contracted with Novatti to do that issuing for them. So essentially the partnership, the license in New Zealand plus the global partnership with Visa brought us a major company,such as Afterpay to be a client in New Zealand. At the same time, in Australia we have a partnership with Ripple, the blockchain company, and because of that partnership, we've been able to get partnerships with companies in a number of Asian countries, who want to work with Ripple and then Novatti as a result. So the global partnerships in the end, bring business to us.

Q16: ACB News:Thank you, Peter. From your personal perspective, Can you tell us a brief picture of Novatti in five years?

Peter Cook: In five years time, I would hope that Novatti is a multi-billion dollar company with extensive operational footprint around the world and that we are one of the major payment companies in the world.

ACB News:We are looking forward to seeing that. This is end of this interview. Thank you so much for your time today, Peter.

Peter Cook: Thank you.

+61

+61 +86

+86 +886

+886 +852

+852 +853

+853 +64

+64